We are now in the 7 month, we are now halfway through 2025, and mutual fund industry is showing strong growth despite of global uncertainty. AMFI realised its June mutual inflow data…..

We are now in the 7 month, we are now halfway through 2025, and mutual fund industry is showing strong growth despite of global uncertainty. AMFI realised its June mutual inflow data this the best time to see where the investors putting their money, how investors navigating markets so far.

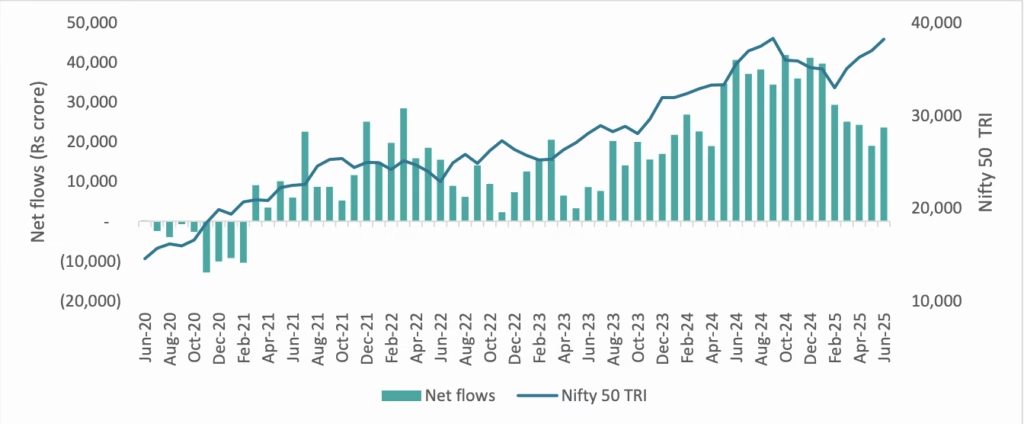

First 6 months of 2025 is not a calm months. in Starting 6 months their is to much geopolitical tensions, and rising global tariff tensions despite all this global tensions indias mutual fund gives superb return.

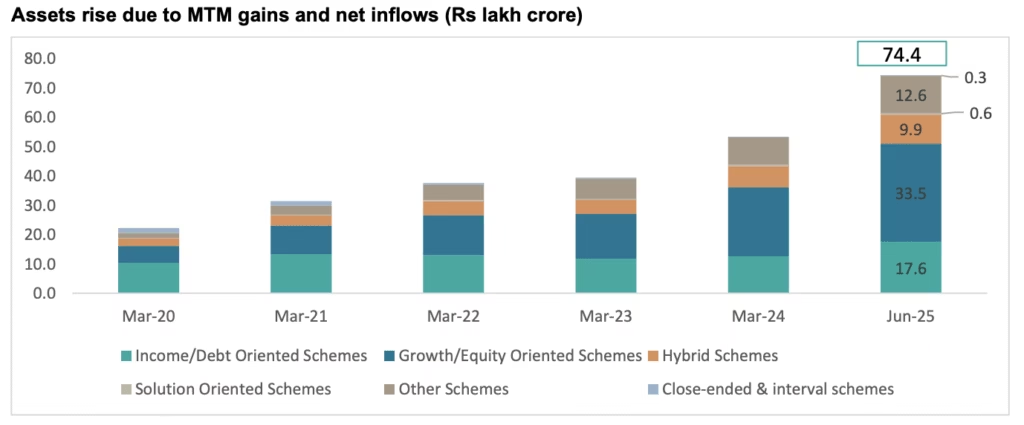

From January to June, Aum of the mutual fund industry is grow by 7 lakh crore. in January Aum is around 67.25 lakh crore and the Aum is 74.41 lakh crore now in June. Thats an impressive jump of 11 % in just 6 months. The growth came from two sources: the increasing value of existing investment and coming inflow in equity, hybrid and debt categories.

Inflows into mutual fund stood at 4.18 lakh crore during this period- thats shows sign people are interested in capital market or debt markets they are willing to take risk.

mutual fund industry to grow at 20% CAGR growth past few years.this mindset shift helps mutual fund industry to grow and Indian investors also showing maturity by staying invested. Despite this chaos, people are focusing on long term investing.

Interestingly, compared to annual inflows recorded since 2000, 2025 already stands out. Excluding 2024, the inflows seen in just the first six months this year exceed the full-year totals of most previous years.

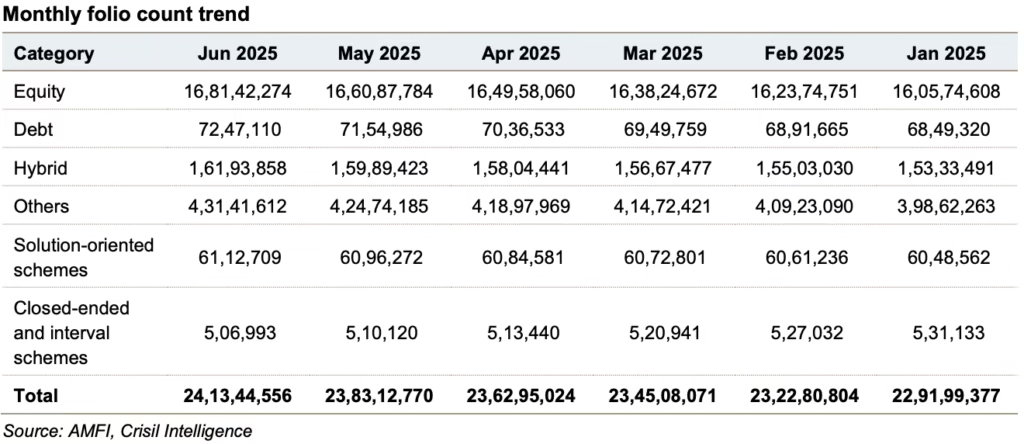

Folio counts sees steady growth

India mutual fund industry 30.32 lakh new folios in just June month. This pushed the total number of folios to 24.13 crore, highlights the retail participation in the capital market. A significant surge came from equity and passive fund segments ,which together accounted for 90% of the new additions. Equity mutual fund is the back bone of the mutual fund industry that accounted for 70% overall folios the number is 16.81 crore folios, and passive fund is reaching 4.31 crore folios or nearly 18% of the total folios. This trend is also showing people are interested in equity mutual funds and passive mutual funds.

Implications of 50 bps rate cut by RBI

On 6 June , reserve bank of India cut repo rate by 50 basis point, bringing it to 5.50% .

This is the third time that RBI is cutting the repo rate ,cumulative to 100 basis points. And the RBI also reduced the CASH RESERVE RATIO by 100 basis points. because of this reason in Indian economy RBI is injecting 2.5 lakh crore rupees. The inflation is also controlled on 4% RBI limit.

Following this rate cut announcement Indian stock market react positively. The rate cut surge In foreign investment , with 14,590 crore rupees pouring into Indian stock market in June.

Equity AUM is continues rising .

Equity AUM is continually rising and reached to RS 33.47 lakh crore in June 2025, this growth Is 4.4% from the previous month.The increase was supported by both market gains and net inflows. DIIs is also continue pouring money in the market, which sustained inflows.

The flexi cap category attracts inflows of Rs 5733 crore in June 2025, maintain its position at a top contributor at equity segment continue for four straight months. Small cap fund is following closely, ranking second for the forth straight month with inflows of Rs 4024 crore. June 2025 also witnessed the four new equity mutual fund offerings by asset management companies. This fund included one fund each in the large cap and in the mid cap or flexi cap categories

Sip trend

Despite volatility people are continued their systematic investment plan, with total contribution reaching to Rs 27269 crore in June 2025. This represent the 2.2% growth from the previous month and a 5.2% growth compared to march 2025. The continues growth in SIP shows people are serious towards building wealth, commitment, confidence and discipline towards SIP.

Another key highlight for june 2025 is SIP assts saw a significant increse of RS 69213 crore, SIP sets have a growth of 14.6% surging from 13.35 lakh crore in march 2025 to RS 15.31 lakh crore in June 2025.. Notably, SIP assets now constitute 20.6% of the total mutual fund industry’s assets, highlighting their growing importance in the mutual fund investment landscape.

The number of Sip accounts is also increasing to 8.64 crore in June 2025 to 8.56 crore in may 2025.

SOURCE: AMFI REPORT

IF YOU WANT TO UNDERSTAND IN DEEP YOU CAN WATCH THIS YOUTUBE VIDEO.

Conclusion

Due to India economic growth and per capita gap growth this number is defiantly will go up and up. In any case you don’t started your SIP start today, build waelth and gave your loved ones happy and beautiful life.