Over the last five years, India’s wire and cables industry has delivered what experts call a “dream run” — steady profits, rising margins, and strong growth. Margins have grown from 6% in 2019 to 10% as of today, according to a recent……..

Over the last five years, India’s wire and cables industry has delivered what experts call a “dream run” — steady profits, rising margins, and strong growth. Margins have grown from 6% in 2019 to 10% as of today, according to a recent report by The Economic Times. The wire and cables industry makes cables and wires that go everywhere — buildings, electrical lines, metros, or in electrical goods like fans and mixers, and so on. The wire and cable industry doesn’t look exciting, but now the industry is in demand and India’s biggest conglomerates are planning to enter the wire and cable space.

We will discuss the growth drivers of the W&C industry.

For the W&C companies, the first quarter of the year is usually not so great, when revenue dips from the last quarter. But Polycab, India’s biggest listed company in W&C, marked its highest-ever first-quarter revenue this year, growing 26% annually to ₹5,960 crore, and the net profit of the company also increased by 49% on a YoY basis, pushing its PAT margin above 10%.

KEI Industries also showed its revenue growth of 25.4% from last year to ₹2,590 crore, same as Polycab. Its net profit also jumped 30% to nearly ₹196 crore. But the margins of KEI are much lower than Polycab. Then there is RR Cables, the smallest company among the above three. RR Cables was listed just 2 years ago. The June quarter is the best quarter for the company, which is why its ₹2,058 crore revenue marked a quarter-on-quarter dip. This is still 13.8% higher than last year. Net margins grew by 39.5% from last year to ₹89.7 crore, but only make up 4.5% of the revenue, a much lower ratio than Polycab or KEI.

Business model of W&C companies.

W&C companies mainly have three business lines: first, they make actual cables and wires; second, they are in fast-moving electronic goods (FMEG) like fans, mixers, lights, etc.; and third, they supply wires or cables for Engineering Procurement Construction (EPC) projects.

Wires and cables

Wire: a single copper strand covered in plastic, used inside homes, switches, and for all small electrical needs.

Cables: a bunch of wires bundled together, designed to carry electricity over long distances or at high voltage. There are three types of cables:

- Low tension cables: voltage range is up to 1 kV, used in residential, commercial, urban, and rural networks.

- Medium tension cables: voltage range is 1 kV to 33 kV, used for industrial, substation, and utility distribution.

- Extra high voltage: voltage range is above 66 kV, used in transmission grids and renewable power.

A lot of investment goes into making cables, and they have to meet the Bureau of Indian Standards’ (BIS) requirements. This makes cables harder to make or deploy than wires. That’s why wires are more profitable than cables.

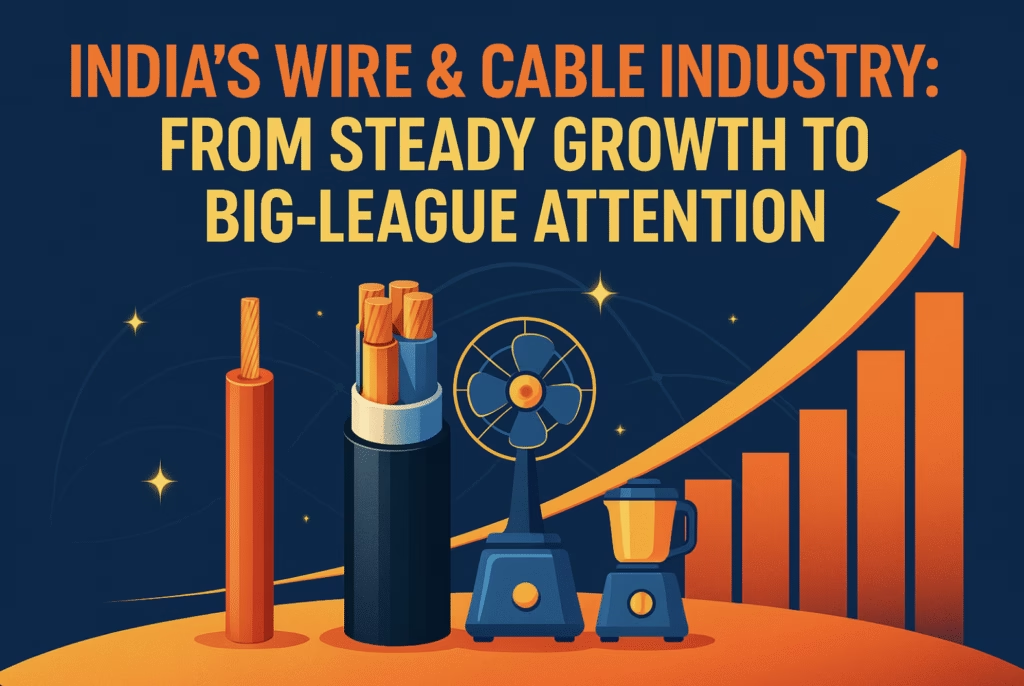

The size of the market

India’s wire and cable market is worth ₹75,000 to ₹85,000 crore today, and it is expected to grow at 8% CAGR, doubling the size of the market by 2032 to reach ₹1.45 lakh crore.

FMEG ( fast moving electronic goods)

W&C companies are focusing on building electronic goods like fans, lights, etc. Electronic goods increase the margins of the business. Polycab has the most advanced FMEG business among the three, with 7.5% of Polycab’s revenue coming from this segment last year. This segment is growing at a rate of 18% YoY. Based on the June quarter, the companies are pushing towards the premiumisation of these products to increase margins. Customers also want fancy fans, lights, and other premium electronic goods.

EPC ( Engineering Procurement Construction)

Most customers don’t know which wire they are using, that’s why the target audience of W&C companies is dealers. Dealer networks are everything — if you have a good network, you can reach more homes. That will increase sales, and a strong network also helps in achieving higher margins.

W&C companies also sell in bulk to B2B EPC projects. These deals bring massive volumes, but the competition is very high and tenders also affect margins. It’s no surprise that this is not the most exciting business line for the wire and cable companies.

The big investment wave

Big W&C players are pouring money into CAPEX, investing ₹11,000 crore collectively. Why are they putting in so much money? The reason is that when you do ₹1 of CAPEX, it can generate ₹5 of sales. This means W&C companies are planning to add ₹55,000 crore worth of sales capacity.

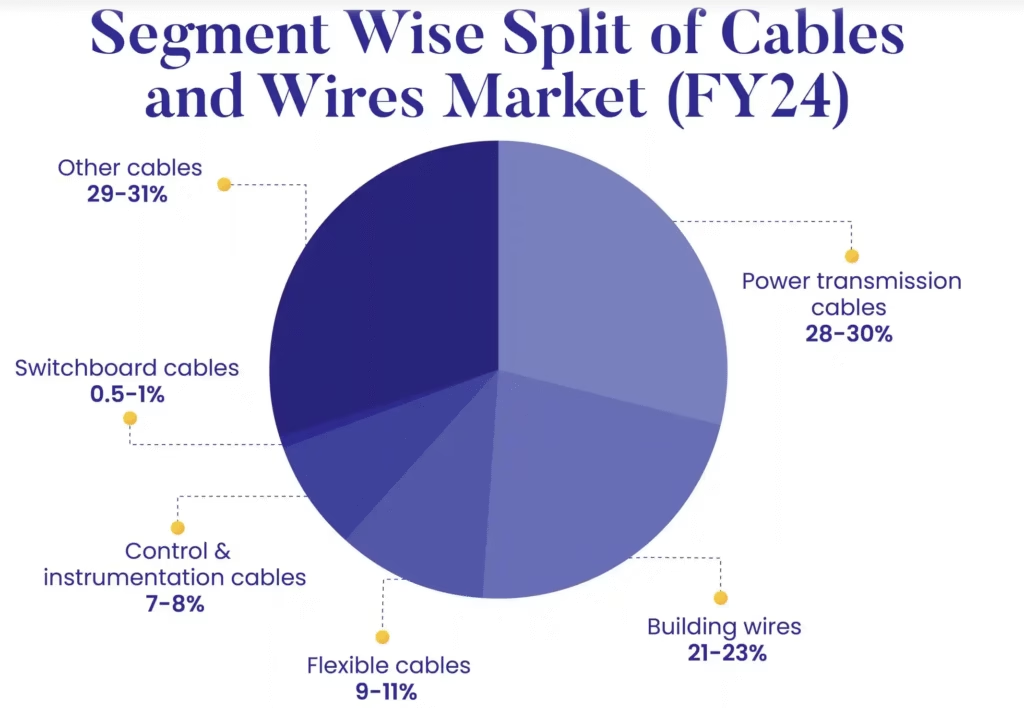

Biggest conglomerates are entering the space

The growth in the W&C industry has not gone unnoticed. Biggest conglomerates like the Adani Group and Aditya Birla Group are entering the W&C industry. They are both major consumers of wires and cables. Adani has huge stakes in power transmission, real estate, solar, and infrastructure — all of these rely on W&C company supplies. If they build in-house W&C arms, it will increase the margins of their businesses. Both Adani and Birla are also cement giants, and most cement projects inevitably need wires and cables.

On the other side, they control significant resources of copper. This gives them access to a steady and low-cost supply of one of the most crucial raw materials.

And there are no entry barriers — still, 25% of the market is unorganised. Wires don’t need heavy CAPEX, and if you know the dealer network, then half of the work is done. Both Adani and Birla have been in these sectors for decades, which will help them build their W&C business.

But incumbents have a lot of years of experience in this field — they have been doing the same job for decades. They are continuously doing CAPEX to improve their presence in the market. Industry veterans say it will take 2 to 3 years to set up production and distribution networks. In the meantime, industry leaders are moving into specialised lines like UV-resistant solar cables.

In short, the sector fundamentals are strong, but for investors, finding the right company at the right valuation is challenging.