Value investing is a long-term strategy to create wealth in the stock market. Warren Buffett is a firm believer in value investing.

AI-GENERATED IMAGE.

Are you tired of losing money in the stock market?

Value investing may be the time-tested solution you are looking for. Value investing became popular because of legends like Warren Buffett and Benjamin Graham. Value investing is not about timing or predicting the market. This method is all about finding hidden gems and holding them patiently.

Value investing is an investing approach centred on identifying stocks based on their fair value (intrinsic value). Imagine a high-value product is on sale—value investing applies the same logic to the stock market. It is the practice of purchasing high-value stocks at discounted prices. Let me give you a proper example: take any good company like Apple. This company has been giving consistent returns over a long period of time. But because of some geopolitical reason, the stock falls and corrects by some percentage. Do you think there is any issue with the business? No—they’re doing fabulously in earnings. But because of some temporary reason, the stock fell. This is the best time to buy Apple stock. This stock is available at a discounted value. This is called value investing.

In value investing, we buy good businesses, not speculate which stock will go up or down. The main idea is to limit our loss. Investors look for stocks whose value is lower than their actual worth. There is a famous quote about the stock market: “Markets make mistakes, but they correct their mistakes in time.” This way, even if the market crashes or we make a mistake, we still have a safety net. It’s like buying something on sale and still getting full value.

Value investing is based on the idea that the stock market does not behave logically. Prices often go up and down because of emotions like fear and greed, not because of company performance. This emotional behaviour gives smart investors the opportunity to enter good businesses at fair or discounted value. That’s why a good value investor needs to stay calm, think clearly, and not just follow what everyone is doing. This strategy is not only a smart way of making money in the market but also safer for conservative investors.

Value investing is all about thinking long-term. It teaches you patience and how to stay calm in difficult conditions. Over time, patience always pays off. This strategy works best for investors who invest their money in the market for the long term, giving the company time to grow and letting the market correct its mistakes. The market can fix any wrong pricing over time.

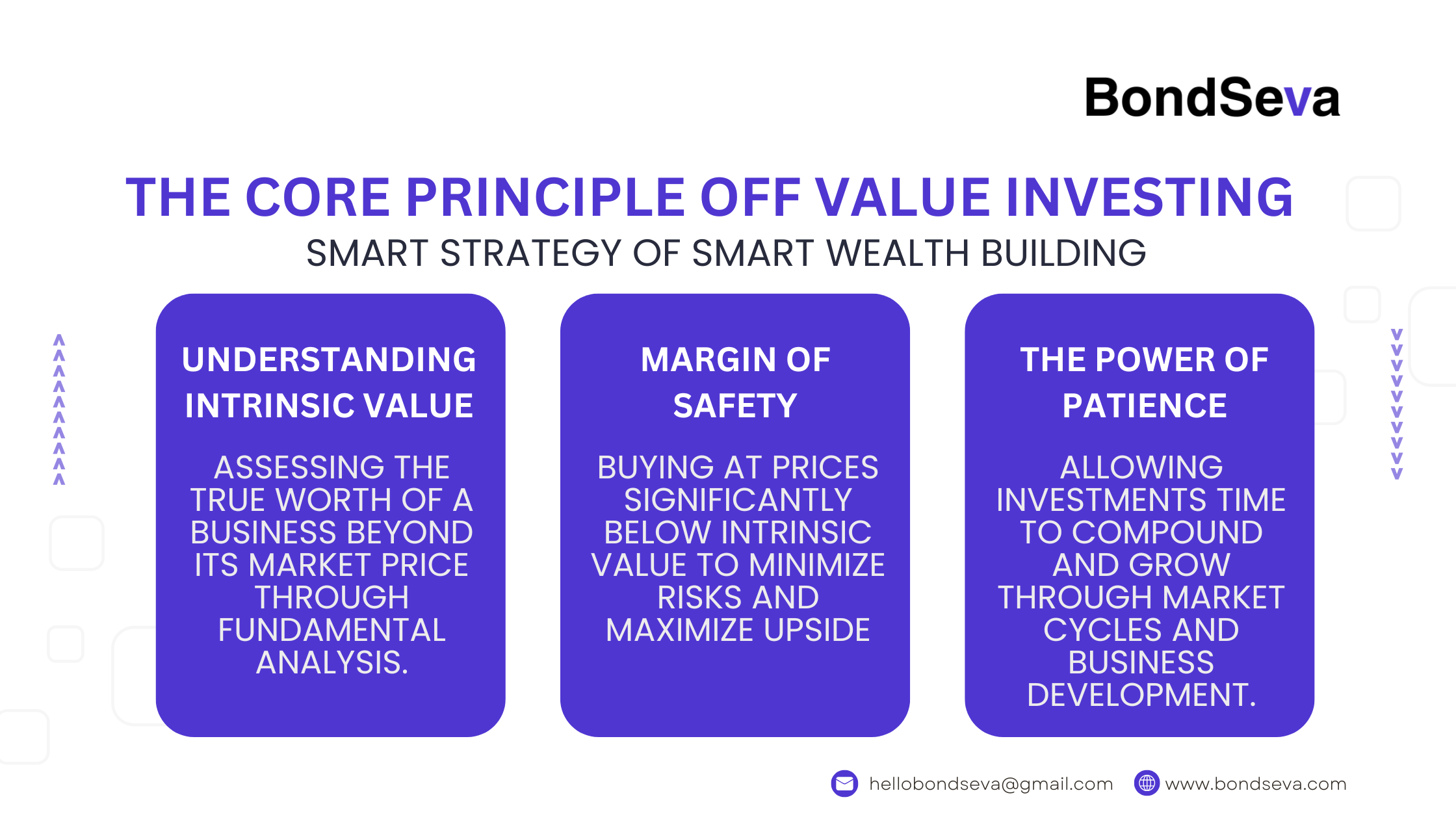

The Core Principles of Value Investing

Value investing is based on a few key ideas that help identify undervalued stocks in the market.

Understanding Intrinsic Value: The Real Worth of a Business

One of the first things value investors look for is the intrinsic value of a stock, not just what it is selling for in the secondary market.

Think of it like buying a home: you don’t buy a home just because your neighbour is selling; you check the size, construction, furniture, etc. Similarly, in stocks, we check the company’s growth, financials, assets, etc., to figure out what the real worth of the business is.

To do this, people predict future earnings and market cap using valuation metrics like Discounted Cash Flow (DCF).

Margin of Safety: Your Safety Net

The margin of safety is one of the most important ideas in value investing. It simply means buying a stock at a low price, leaving room for error.

If you believe a stock’s real worth is ₹500, you don’t buy it at ₹480 or ₹490—you buy it at ₹400 or ₹350. This gives you a cushion for error. If the market falls afterwards, it doesn’t affect you much because you bought at a price below intrinsic value.

Warren Buffett explains this with a bridge example: if the capacity of a bridge is 40,000 pounds, you don’t load it with 39,900 pounds—you give yourself a safety net. The bigger the discount you buy at, the more room for error you have.

The Power of Patience: Think Long Term

If you want to build wealth from the stock market, you have to invest for the long term. Your chances of creating wealth increase drastically.

Think of investing like planting a tree: you plant the seed, water it, and wait. You don’t check every day or panic. You know a tree cannot grow instantly. That’s how compounding works. Your money starts earning more money over the years, and it grows much faster than you expect.

Read More About StocksHow to Find Undervalued Stocks

Value investors always rely on a company’s financials to know how healthy the company is and how it’s doing business. These valuation ratios help them do proper analysis:

Price-to-Earnings (P/E) Ratio: How Much Are You Paying for Profit?

P/E ratio represents how much you are paying to generate profit.

Example: If Apple’s P/E ratio is 20, it means you are investing ₹20 to earn ₹1.

But sometimes, a low P/E means the company is in trouble. In growing sectors, companies usually have high P/E ratios because people are more interested in buying those stocks.

Price-to-Book (P/B) Ratio: Is the Company Worth More Than Its Assets?

Many investors use the P/B ratio to compare a firm’s market capitalisation to its book value (net worth of the company). It helps identify whether the company is undervalued or overvalued.

Return on Invested Capital (ROIC): Is the Company Using Money Wisely?

ROIC shows how much money the company generates from the capital it has invested.

This ratio helps identify how efficiently a company is using its capital.

Debt-to-Equity (D/E) Ratio: Assessing Financial Health

The D/E ratio helps investors understand how much debt the company has taken concerning its equity.

Note: These metrics are not universal. Every industry has different standards. When analyzing, always compare with peer companies in the same industry.

In Short

We now understand value investing and the metrics used to find undervalued stocks.

If you liked this article, please comment—it gives us motivation.

And don’t forget to share it with your friends and family.

Thank you for reading the entire article.