Learn about the importance of savings. Identify avenues to invest the savings in a suitable investment vehicle. Compare historical returns generated by different assets, and know what to expect from you ..

Why Should I Invest?

First, let’s understand what savings are.

Savings is the money left after your expenses and spending from your earnings over a given period. It shows how much money you have left after paying for all your obligations.

Savings are generally held in cash or cash-equivalent instruments like bank deposits, which is why the return is usually minimal.

People save money for various future goals, like buying a car, a house, funding their children’s education, emergency needs, or vacation planning. These savings provide individuals with a sense of confidence and security.

If your bills and spending are consuming your entire income, you’re in a tough financial situation. You’re not managing your money properly, and it may be time to consult a financial advisor to guide you on your financial journey.

How to Calculate Savings

Income – Expenses = Savings

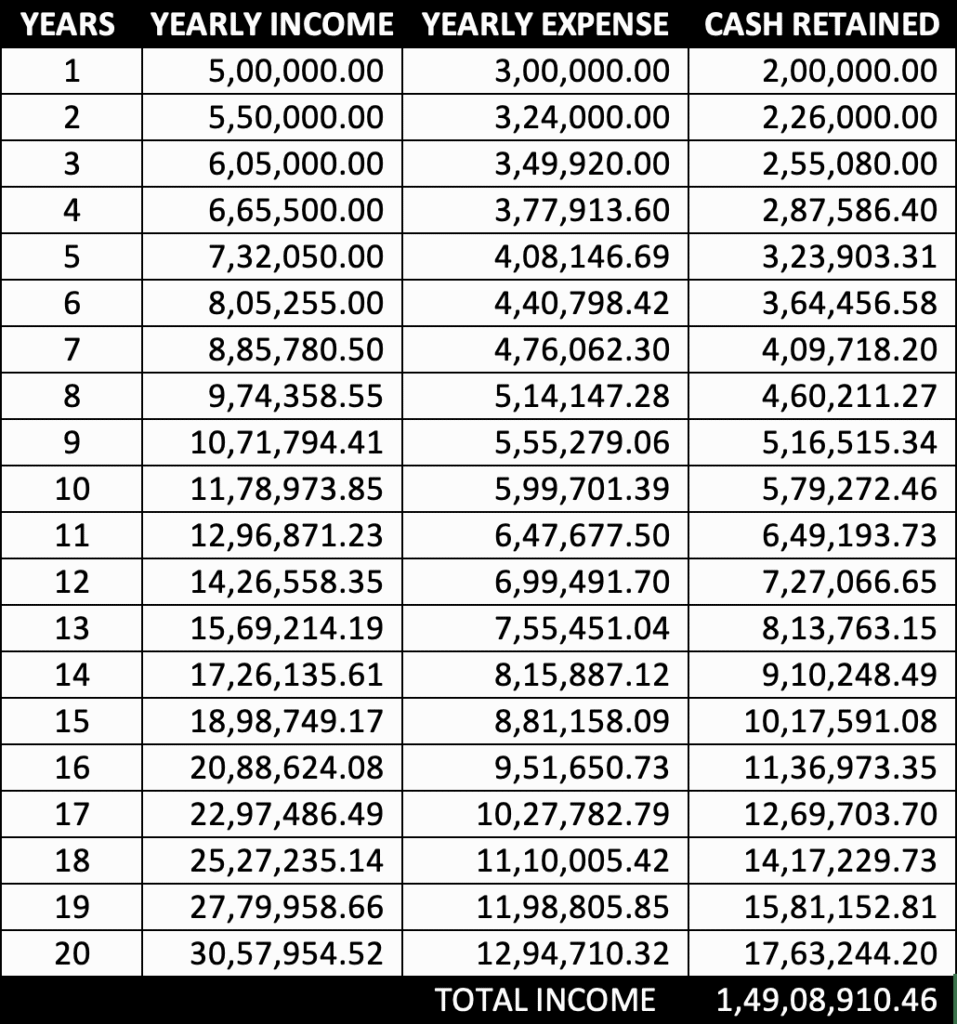

Let’s understand this with a live example and a chart.

Assume the following:

- Your annual income is ₹5,00,000.

- Your annual spending is ₹3,00,000.

- You are 30 years old and plan to retire at 50.

- Your salary increases at 10% CAGR each year.

- Your expenses increase by 8% annually.

(For simplicity, we are not considering any direct taxes.)

Let’s calculate how much you’ll save over 20 years.

You save ₹1.49 crore in 20 years. Since your expenses are fixed and you’ve already bought a home or car, after retirement, you’ll have a surplus of ₹1.5 crore.

But your expenses are growing at 8%. With ₹1.5 crore, you can survive for 8–10 years. After that, you may run into financial trouble.

So, how can you increase this amount?

This is where investing comes in—it helps grow your corpus and extend the sustainability of your retirement fund.

What Is Investment?

An investment is an asset or property acquired to generate income or gain in value over time.

Appreciation means an increase in the value of the asset.

Example: If your father bought a home 10 years ago for ₹20 lakh and now it’s worth ₹40 lakh, the value has appreciated by 100%.

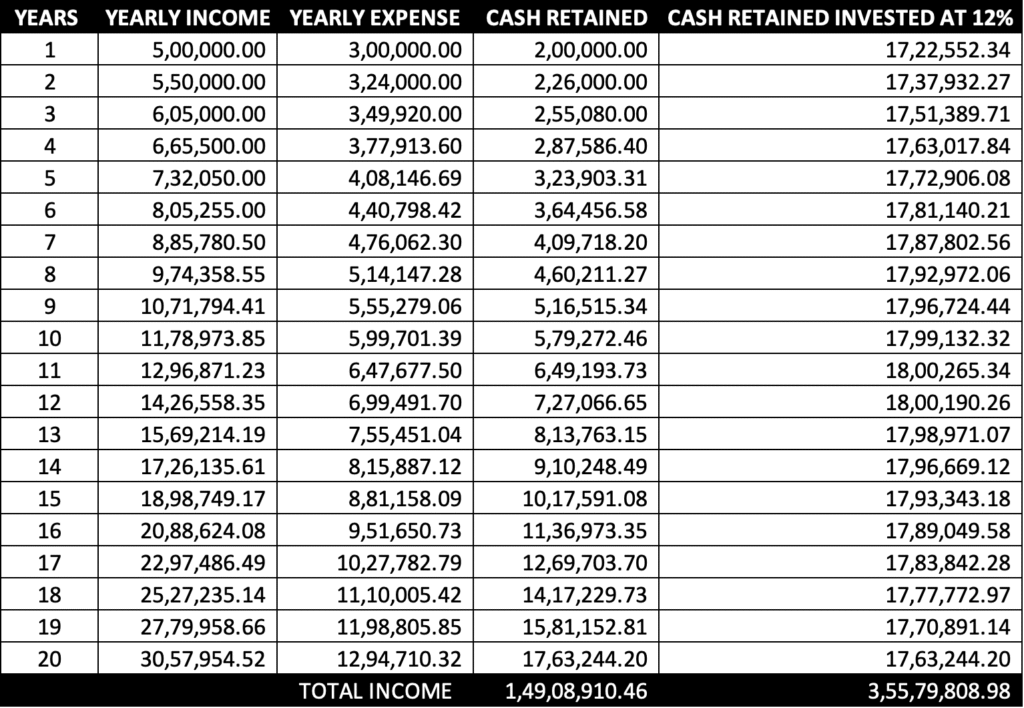

Now, let’s go back to our previous example. But this time, you invest your retained savings in assets that yield a 12% annual return—a figure you can reasonably expect without taking major risks.

Now, instead of ₹1.5 crore, you end up with ₹3.55 crore.

This is the power of investing and compounding.

With this amount, you can now survive for 15–20 years after retirement.

Still think it’s not enough?

You can also opt for an SWP (Systematic Withdrawal Plan).

What is SWP?

In an SWP, you invest a lump sum in a mutual fund and withdraw a fixed amount every month to cover your expenses. The remaining amount continues to earn returns. This reduces your fear of running out of money.

Where Should You Invest?

Don’t worry. First, introspect:

- Are you comfortable taking risks?

- Or do you prefer to play it safe?

Once you understand your risk appetite, you’ll know where to invest.

Investment Options

There are many instruments available in the market. Some offer fixed returns, while others can give higher returns of 15–20%, but with more risk.

1. Fixed Income Instruments

These include:

- Fixed Deposits (FDs) in banks: 6–7% per annum.

- Bonds: Returns range from 7–12% per annum.

What is a bond?

A bond is a fixed-income investment where you lend money to the government, corporations, or institutions to meet their expenses.

Types of bonds:

- Government Bonds: ~7% per annum. Very safe.

- Corporate Bonds: ~10–11% per annum. Slightly riskier than government bonds.

If you want to know more about bonds, click on the link provided.

2. Equity

Investing in equity means buying shares of publicly listed companies on exchanges like the NSE (National Stock Exchange) or the BSE (Bombay Stock Exchange).

Equity investments don’t offer guaranteed returns like fixed income. You might earn 25–30% in some years, or only 6–10% in others. There’s always uncertainty.

If you’re ready to handle that uncertainty, you should study equity. Unlike fixed income, equity investing requires research and analysis before putting your money in.

3. Real Estate

Real estate is a favourite investment option in India.

Many people invest in land or property simply because they believe prices never go down.

From real estate, you earn in two ways:

- Rental income – 2–3% annually.

- Appreciation – The Value increase of the property over time.

Usually, real estate requires a big investment (₹10 lakh or more).

But now, thanks to REITs (Real Estate Investment Trusts), you can start with as little as ₹1,000.

4. Commodities

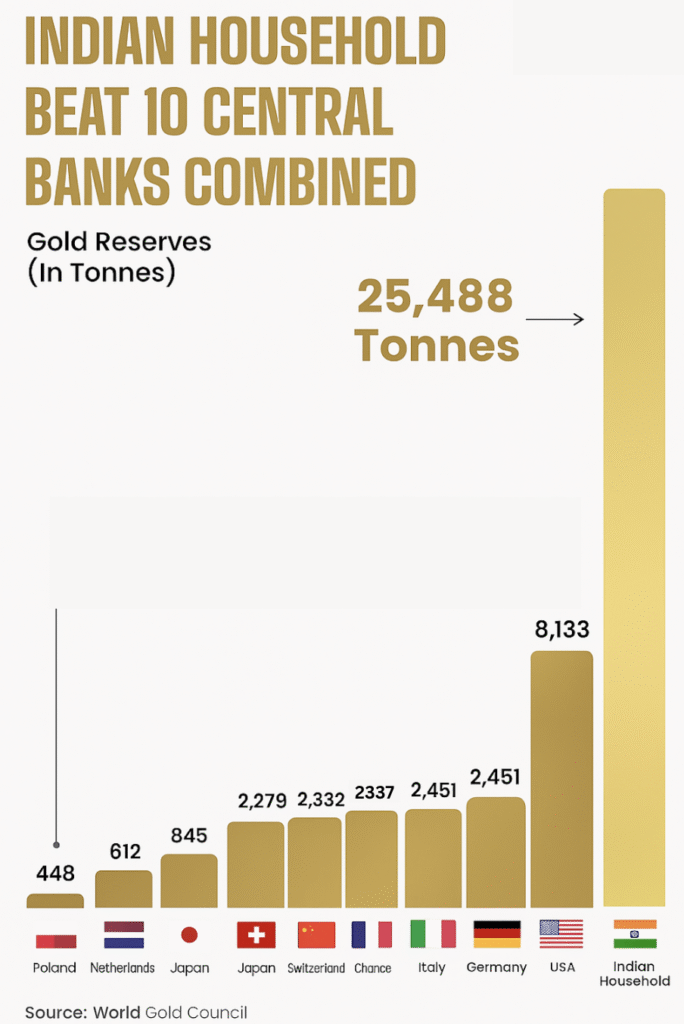

Commodities—especially gold—have always been a popular investment in India.

Indians have been investing in gold for generations.

Interesting Fact:

Indian households collectively hold more gold than the top 10 central banks combined.

What About Cryptocurrency?

Many of you may be wondering why cryptocurrency isn’t mentioned.

That’s because crypto is still not properly regulated in India.

As responsible investors, we must look for proper regulatory frameworks, checks, and balances to protect our investments.

You’re investing your hard-earned money—security matters.

Conclusion

Now you know why investing is important.

If we missed anything, feel free to leave a comment—we’re here to help.

Stay invested. Stay happy.

Share this with friends and family.

Thank you so much for reading!