Indian stock market is ready to see something big, the largest ever REITs IPO is ready to be listed in the market, the company name is Knowledge Realty Trust. This company is planning to raise around 4,800 crore

Indian stock market is ready to see something big, the largest ever REITs IPO is ready to be listed in the market, the company name is Knowledge Realty Trust. This company is planning to raise around 4,800 crore from the public. If you are thinking what big about this then to give you an idea how huge this is, it’s even bigger than National Securities Depository Ltd (NSDL) IPO earlier this year.

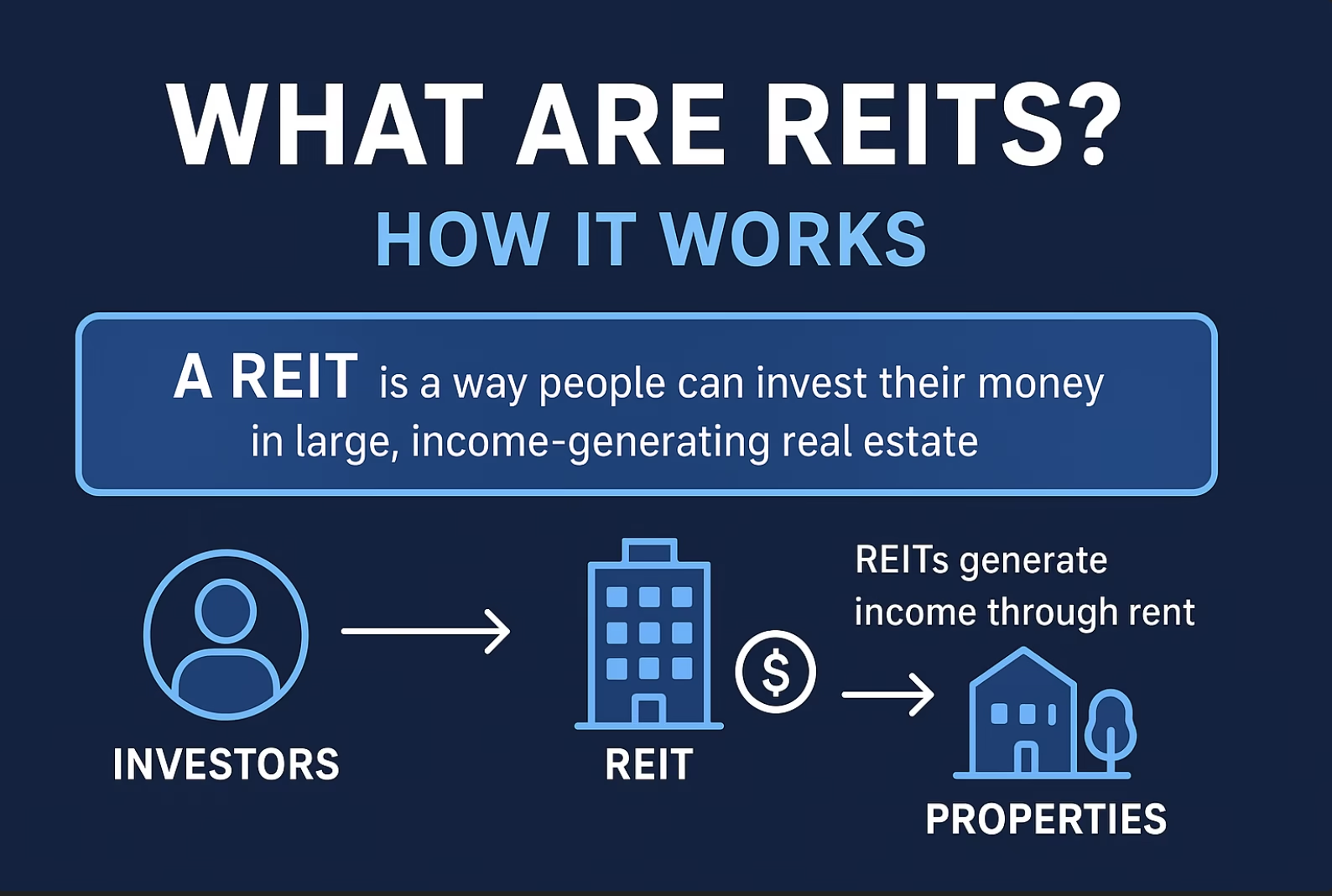

But people don’t have an idea what is REITs? And how is it different from other company stocks?

Let’s break it down

What are REITs?

When you go in metro city you see big parks, malls and offices, in mind you think whose is owning these parks, malls and offices, how much rent he is earning. Now because of REITs you can also do the same thing what this businesses does.

A REIT or “real estate investment trust“ is way people can invest their money in big real estate projects like parks, malls and offices, without actually buying the building or finding the tenants worrying about these things.

REIT is like a mutual fund for real estate, think of it like mutual fund but instead of pooling money for buying stocks, in REITs everyone pools money for buying real estate or manage it.

Now you have doubt then what is different between buying the real estate company stocks or REITs?

When you buy a company in real estate sector you’re buying the whole business and betting on it. Buying land, building it and selling it on a profit all of these things you have to keep in mind. This involves many risks like getting approvals, finishing constructions on time, managing the money well and predicting the market to reward you.

But with REIT, you are investing your money in already ready building and rented out. At least 80% of REITs assets are already completed their construction and tenants paying the rents. The rent is shared with investor you and me, in REITs you don’t have to think about business or construction delays you just have to put your money and you will get rent in return.

So what’s we are actually buying?

We are buying the units of REITs trust, a legal setup who owns the properties or manage it. This trust is regulated by SEBI and registered by SEBI.

we will understand how REITs works?

Sponsor

Sponsor is the original property owner or developer, who starts the REITs. They already own property and now they want to turn properties into money making investments that’s why they transfer this property to REITs.

SPV (special purpose vehicle)

A property usually doesn’t go directly to REITs, it’s messed legally then they create a separate company that company holds the property and the company called as SPV. SPV is held by the trust. A REIT can have different SPVs, each can hold different properties.

Trustee

Once property is in the SPV then the third entity comes in picture to keep eyes on things. Their job is to make sure that trust works in the investor favour, they are the watchdog of REITs. Like the board of any company.

Investment manager

While trustee watch the trust but manage operational things of REITs is managed by investment manager. Like dealing with tenants, collecting rents and buying new properties.\

Unit holders

That’s you and me – investors, you buy REIT units in return you get the share of the income it makes.

If the price of assets goes on value up, the REIT NAV is increased over time this can push your market price of REITs units so you get capital gains when you sell your units. But unlike rent the appreciation is paid out when the property is sold in profit. which is rare, since most REITs focus is on holding income-generating assets and try to not sell it.

At first, the sponsors are majority holders of the trust a little like the promoters of a company. But when the REIT does an IPO either raising fresh money, or having sponsors sell off existing units they hold. That’s when you come in.

Any fresh money comes through IPO is used for acquiring new assets.

Evaluating the REITs

REIT is like a company who owns a bunch of buildings like malls, offices, apartments, warehouses and rents them out. When you invest your money you’re not putting in one building you are putting in many buildings.

What type of buildings they own

Like some REITs only own offices they don’t own the malls, warehouse and apartments. And at which cities their building are in metro cities or any other cities.

Are those office assets full or empty

Empty means no rent, less money for you, but few companies own the large chunk of assets if they go that will affect a lot that thing you should keep in mind.

Who is your tenants

You should know who you are giving your assets and won’t leave suddenly.

How long will tenants stay

If leases end quickly, companies can leave that affects income, the average industry lease is 7.4 years.

How much money does it make

Like when you earn rent after deducting all the operation expense leftover money will be distributed to investors.

Final takeaway

We have looked at the basic checking on REITs but there is more in REITs, like how much money is borrowed by REITs, they are giving regular payment to investors, the management of REITs is honest or not, or they are buying new properties or not and they are buying at a fair value.

The truth is any investment can go wrong like stocks, bonds or REITs you have to be careful before putting your money.