Curious about IBIT? Discover what the iShares Bitcoin Trust ETF is, and learn why it’s a good crypto investment for 2025. Full analysis and its risks. inside

What Is IBIT (iShares Bitcoin Trust ETF)?

The iShares Bitcoin Trust ETF is an ETF launched by the world’s largest investment firm, BlackRock, in January 2024. It is a spot Bitcoin exchange-traded fund.

BlackRock launched it after getting approval from the United States Securities and Exchange Commission. BlackRock is the world’s largest asset management firm, which manages more than $12 trillion in assets.

By launching this fund, BlackRock opens the door for investors to get exposure to the exact price of Bitcoin without owning or managing cryptocurrency by themselves. Without any wallet keys or any crypto exchange platform, now investors can buy or sell it directly via their brokerage account, just like stock or regular ETFs.

Key Features:

- Asset Cover: BlackRock holds $85.98 billion worth of bitcoin, which is nearly 717,388 bitcoins under their IBIT fund directly. It makes BlackRock one of the largest Bitcoin holders among institutions in the Bitcoin market. Each Bitcoin is reflected in some shares of IBIT. Investors can get that share and can own the share of a fraction of actual Bitcoin, which is securely held by BlackRock, typically by Coinbase Custody.

- Regulation: When we think about crypto, we are concerned about security and regulation. As it is registered under ETF means IBIT is going to be regulated under the United States’ financial laws, which offers us great security and transparency then many other unregulated crypto investment modes.

- Accessibility: BlackRock makes Bitcoin investment easy for every investor. Through their IBIT fund, they allow investment in Bitcoin for investors with retirement accounts.

- Liquidity: The shares of IBIT can be bought or sold throughout trading hours on major stock exchanges.

In very little time, IBIT fund became the world’s largest spot Bitcoin ETF, reflecting growing institutional interest in Bitcoin as a legitimate asset class. This fund charges around 0.25% annually as a management fee.

This fund has a straightforward representation as a regulated and secured gateway for traditional investors to participate in the new age crypto market.

How IBIT Works?

This ETF works as a traditional ETF but is supported by physical (spot) Bitcoin. BlackRock bought the bitcoins and they are holding it securely, and the value of shares tracks Bitcoin’s real-time market price.

Buying IBIT Shares:

- We can purchase IBIT shares from our brokerage firm, just like we buy stock (just like a stock or traditional ETF).

- Now it’s an easy and hassle-free crypto investment; no need to manage different crypto wallets, private keys, or deal with crypto exchange platforms.

- We are going to receive price exposure to Bitcoin, but the ETF’s management fee has to be subtracted from this.

Underlying Custody:

- All the Bitcoins are held in cold storage by Coinbase Custody. It is a leading custody provider that offers institutional-grade security.

Redemption and Liquidity:

- Market makers can add or remove IBIT shares by trading them for actual Bitcoin instead of real cash or money. This makes it possible to keep IBIT’s price very close and accurate to the real price of Bitcoin.

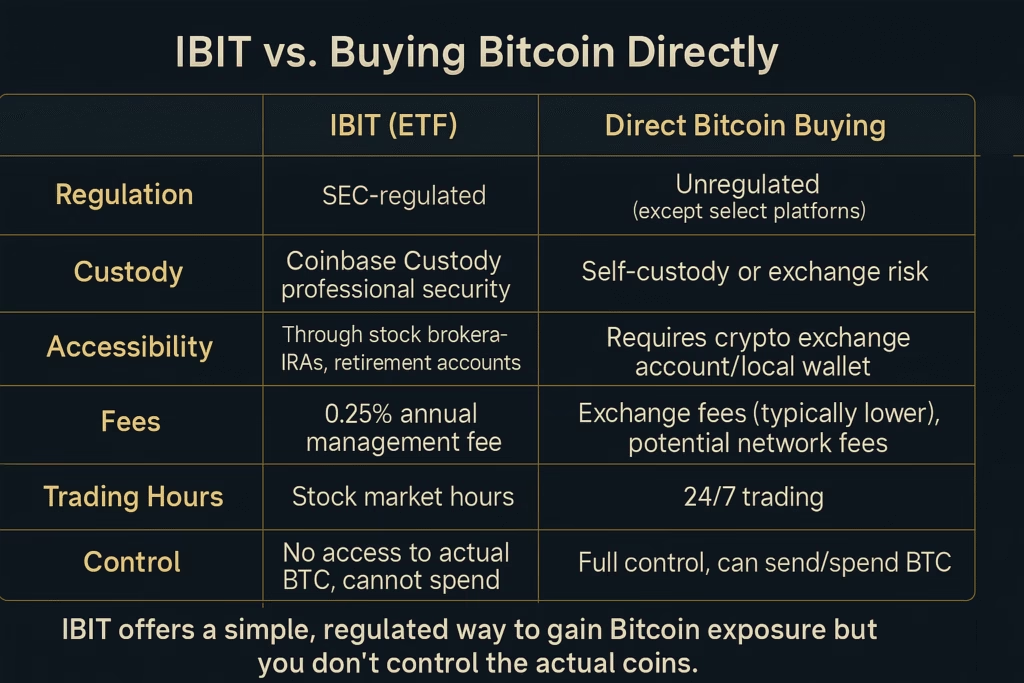

IBIT vs. Buying Bitcoin Directly

| IBIT (ETF) | Direct Bitcoin Buying | |

| Regulation | SEC-regulated | Unregulated (except select platforms) |

| Custody | Through stock brokerages, IRAs, and retirement accounts | Self-custody or exchange risk |

| Accessibility | Through stock brokerages, IRAs, retirement accounts | Requires crypto exchange account/local wallet |

| Fees | 0.25% annual management fee | Exchange fees (typically lower), potential network fees |

| Trading Hours | Stock market hours | 24/7 trading |

| Control | No access to actual BTC, cannot spend | Full control, can send/spend BTC |

Summary: This ETF offers a simple, regulated way to gain Bitcoin exposure, but you don’t control the actual coins.

IBIT Performance and Price in 2025

Performance (Jan 2024 – July 2025):

- IBIT’s return closely follows Bitcoin’s price, as Bitcoin increased a lot in 2024 and its price moved up and down many times in 2025. So IBIT did the same.

- IBIT holds more than $85 billion in assets as of July 2025 and also tracks around 720,000 Bitcoins. This shows strong interest from both regular and big investors.

- The popularity of IBIT helped Bitcoin become more widely accepted and may have helped in reducing its price swings.

Price Tracking:

- IBIT’s share price mostly stays in line with Bitcoin’s market price (99%+ match), with only small differences that come due to fees or delays

Pros and Cons of Investing in IBIT

Pros:

- Safe and Regulated: IBIT is supported by our financial legal rules, which give investors a sense of security and peace of mind not need to worry about getting hacked or losing crypto.

- Easy to Use: Now you don’t need to create and deal with wallets or exchanges for bitcoin transactions. We can directly buy IBIT through a regular stockbroker or retirement account.

- More Access: by making MTF it become accessible to everyone, like Big investors and retirement funds, can also invest in Bitcoin through IBIT.

- Quick to Buy/Sell: it can be easily purchased or sell your position during normal market hours—just like a stock.

- Good for diversifying: it opens new doors of investment for many people, IBIT gives you diverse and crypto investment exposure inside a traditional portfolio, without buying actual crypto.

Cons:

- You Don’t Own Real Bitcoin: as IBIT is an MTF fund, we cannot transfer or spend bitcoins, and also can’t be used for things like Defi or NFTs

- Annual Fee: IBIT charges a 0.25% yearly fee, which could cost more than holding real Bitcoin over the long run.

- Limited Trading Hours: Unlike Bitcoin, which trades 24/7, IBIT only trades during stock market hours.

- Price Gaps: Sometimes, especially in volatile markets, IBIT’s price might be slightly higher or lower than the actual price of Bitcoin.

- Rule Changes: if the United States government changes laws around crypto or ETFs, it can affect IBIT fees and working

Is this ETF a Good Investment in 2025?

For Most Investors:

- IBIT is a relatively safe, regulated, and simple way to gain Bitcoin exposure, especially for those who don’t want to self-custody crypto.

- It fits well within diversified portfolios looking for “alternative assets” with growth potential.

You Should Consider If:

- You want exposure to Bitcoin with regulated protections.

- Prefer holding assets with traditional brokerages, IRAs, or retirement accounts.

Caution If:

- You want full control over your Bitcoin and desire to participate in DeFi, staking, or spending BTC directly—IBIT is not for you.

- You expect rapid, round-the-clock trading opportunities; IBIT is limited to stock market hours.